Being a person who has gone through all the good and bad trying to find the most inexpensive auto insurance, I can assure you that finding the cheapest coverage is not an easy thing. However, be confident to read my story, which is what I am going to share with you, and get some precious tips and tricks to deal with this multifaceted world, which, in the long run, may even bring you the likelihood of getting a saving of hundreds of dollars on your premiums, cheapest auto insurance.

Understanding Auto Insurance Basics

Before we deal with methods of acquiring low-cost auto insurance, it is important to know what exactly you are paying for. Auto insurance mostly covers:

- Liability coverage (for damages you cause to others)

- Collision coverage (for damages to your car from accidents)

- Comprehensive coverage (for non-collision related damages, like theft or natural disasters)

- Personal injury protection (for medical expenses)

- Uninsured/underinsured motorist coverage

Cheapest car insurance is, as a rule, the minimum demanded policy in your state which, in most cases, is only liability insurance. Nevertheless, it is crucial to reflect on whether the most affordable option provides the necessary outreach for your needs.

Factors That Influence Your Auto Insurance Rates

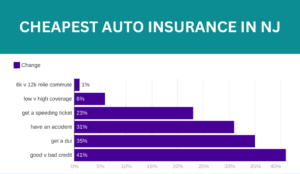

My quest for low-priced auto insurance has been thanks to the realization that insurers have their own set of factors for deciding what you pay. Knowing these factors can give a piece of mind knowing in what areas might be flexible for your expense and that you might be able to lower your costs:

- Driving record

- Age and gender

- Vehicle type and age

- Credit score (in most states)

- Location

- Annual mileage

- Coverage types and limits

- Deductible amount

Strategies for Finding the Cheapest Auto Insurance

Ok, now let’s go to the bottom line and consider what methods are there really to find these rock-bottom prices we all strive for. Here are some strategies I’ve been using to keep my premiums down:

1. Shop Around and Compare Quotes

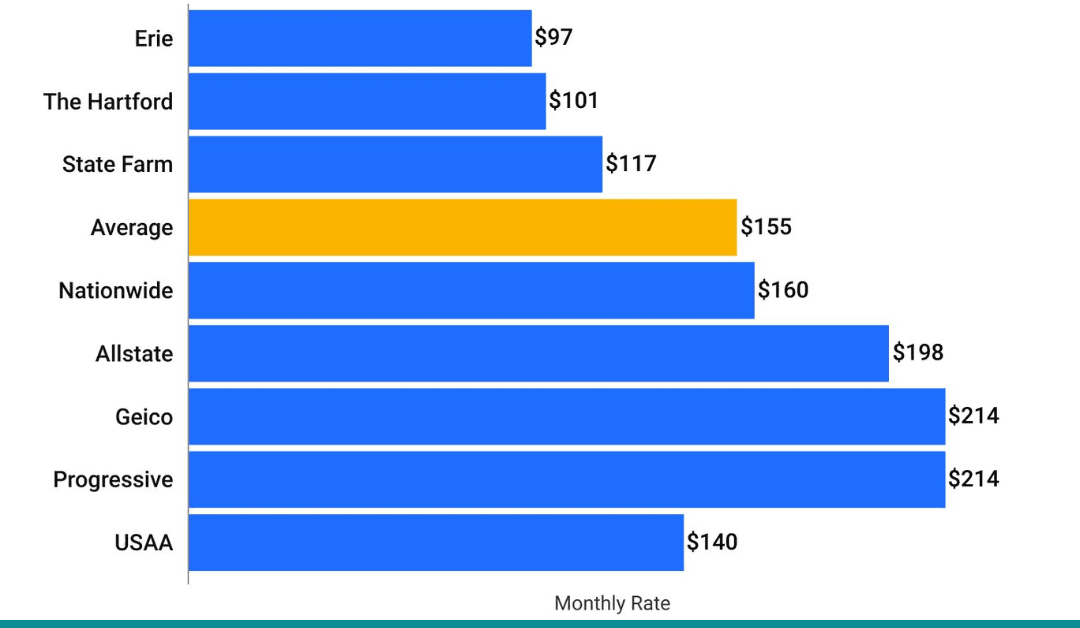

The tip that has the most influence on your car insurance bill is this one. Don’T say yes to the first quote you get. I often get quotes from at least three different insurers as my policy is coming up to the renewal period. The online comparison tools have made this whole process much easier, but donT forget that local independent agents usually have deals that are not available online.

2. Look for Discounts

A large number of insurance companies of varying kinds offer quite a wide range of discounts, some of which you may not even think that you are entitled to. Some typical discounts include:

- Safe driver discount

- Good student discount

- Multi-policy discount (bundling auto with home or renters insurance)

- Multi-car discount

- Safety feature discounts

- Professional or alumni association discounts

Of course, I have found that a simple inquiry about potential rebates has often been surprising and resulted in savings that I did not expect.

3. Increase Your Deductible

Choosing a greater deductible can have a marked effect on your bill with insurance. Though, make sure that the increased out-of-pocket if you have to file a claim still lies within your financial ability. As I am a cautious policyholder, I rose the deductible from $500 to $1000 and got my premium reduced noticeably.

4. Maintain a Good Credit Score

This is a major factor in the majority of states, where insurers resort to credit-based insurance scores for the determination of rating levels. Keeping a good credit score may lead to lower premiums. It has been my main priority to make my payments in a timely manner and have as low a credit utilization rate as possible. Improvements in these areas have directly led to my insurance rates being decreased.

5. Drive Safely

Well, this is pretty obvious, however, regularly reminding yourself to abide by this is still going to be beneficial. Having a clean driving record is the surest way to keep your premiums low. No speeding tickets, accidents, and other driving-related offenses. There are even some insurers that provide applications through which they monitor your behavior in traffic and, if you drive properly, also attribute there some discounts.

6. Consider Usage-Based Insurance

Hello! If you go fewer miles, using a telematics program may be a nice idea as you can save a lot of money. These programs deploy small telematics boxes that are installed under the dashboard of your car and normally can cut your costs by as high as 40% if you’re performing really well in your behavior on the road.

7. Choose Your Car Wisely

The vehicle, you drive, is one of the most effective ways of controlling your insurance charge. Generally, old safe cars are cheaper to insure than new, luxurious ones. I remember when I was car shopping, I made sure that I had insurance quotes for the cars I was considering, and the discrepancies in those quotes were truly striking!

8. Maintain Continuous Coverage

Even short lapses in insurance will frequently lead to higher rates once you go back to your insurance company. Therefore, in order to stay away from this so-called penalty, I have always been careful to keep continuous coverage even when I change insurers.

Balancing Cost and Coverage

While finding the cheapest auto insurance is essential, it is equally necessary to make sure that you have the right amount of coverage. It is the cheapest policy that is not always the best choice if it leaves you exposed to large out-of-pocket expenses in a car accident.

When I chose the minimum coverage term only for cost savings once, I learnt my lesson the hard way. In my particular situation, a different one was not so much the best one to choose. Further, to my earnings were a bit higher for getting the coverage I intended, but it was all worth it as I never had to spend money on the insurance side.

The Importance of Regular Policy Reviews

Changes in coverage needs and the competitive environment among companies could also occur, which means this is not something that you do only once. Besides time intervals I have set up, I constantly review my policy, even if at the moment I am satisfied with my existing insurer. This method can help me do the following:

- Be sure that my insurance still does what I want it to do

- Use new incentives I may be offered

- Provide comparative analysis with other insurers

It has sometimes been so astonishing to me that I have managed to get better rates or use the policy more effectively when I do the annual review of my insurance coverage!

The Role of Technology in Finding Cheap Auto Insurance

Technology seems to have changed the insurance shopping game a lot. Here are the tech-based instruments I have found useful on my cheap auto insurance mission:

- Comparison websites: These are sites that enable you to compare quotes from different insurers all at once.

- Insurance company apps: Many insurance companies now have mobile apps that allow you to manage your policy, report claims, and even accumulate discounts.

- Telematics devices: They will gather data about how you drive a car and give you insights on how to lock in savings for clean road courses.

While these tools can help a lot, I make a point of reading the terms carefully and knowing exactly what I am signing up for, particularly with telematics devices data privacy.

When Cheap Isn’t Always Best

Bearing in mind that cheap auto insurance might be an important aim of yours, the situation is that you should also be ready to pay a bit more if necessary. For example:

- If you have assets that are substantial enough to need protection with higher liability limits, then the extra cost might be a small price to pay.

- If you live in an area that is often struck by natural disasters, taking out comprehensive insurance might leave you with something to hold on to in the long run.

- If you have a new or a valuable car, comprehensive coverage will be the right one for protecting your assets.

I have learned that I should acknowledge that I won’t always find the cheapest option which means the price issue isn’t the only thing to consider. But if I follow the guidelines I have given you, I will then be perfectly equipped to the car insurance domain and the suitable type of coverage will be sourced for you.

Conclusion

To find the cheapest auto insurance, one has to invest effort, research, and at times even be ready to yield a bit. By clearly understanding the major factors that influence the rates paid, actively seeking the available discounts, and regularly updating the policy, one can potentially save around 100$ each year.

For one thing, this is not only a matter of finding the cheapest policy; it is as well the purchase of the most affordable policy that might or not do the job for you. With the strategies that I have shared, the capacity of learning auto insurance will be yours and you will have ample ground to seek the proper option for your unique needs.

Frequently Asked Questions (FAQs)

What is the cheapest type of auto insurance?

The minimum liability policy is generally considered to be the cheapest kind of auto insurance. However, this standard one doesn’t provide enough security in many cases and in most cases it is only liability insurance in the state of your choice.

How can I lower my auto insurance premium?

There are quite a few things you can do to slash your premium which involve:

- Checking other insurers and going to the cheapest one

- Putting your deductible high

- Utilizing discounts to the full extent

- Maintaining a clean driving record

- Raising your credit score

- Ascribing to car safe lists that insuring companies prefer

Is it worth it to have full coverage auto insurance?

The decision will rest on your particular circumstances. It might be a good idea to take full coverage in case of a new or more expensive car or if you are unable to buy a new one if in the case of an accident it gets wrecked. However, if your car is an old model or it’s of low value, whole coverage costs may not be worth the potential benefits.

How often should I shop for auto insurance?

Without any question, it is good to attend to shopping around for auto insurance at least every year when your policy gets renewed. You should also consider doing this with the major life changes such as when you move, when you get married or when you buy a new car.

Does my credit score affect my auto insurance rates?

Yes, in most states. Insurance companies do, frequently, make use of credit scores for insurance pricing. Usually, a high score will result in a low insurance amount.

Are there any downsides to choosing the cheapest auto insurance?

A: The cheapest insurance does not always fulfill your needs. It might leave you with a large bill if you have to deal with a serious accident. Always make sure you are aware of what is included in coverage before choosing based on price.

Can I get auto insurance discounts for being a safe driver?

Yes, many insurance companies offer safe driver discounts. These can be based on your driving record or, increasingly, on data collected through telematics devices or smartphone apps that monitor your driving habits.

How does my choice of car affect my insurance rates?

Your car choice seems to be the biggest element in the outcome of your insurance rates. Your candidate’s safety level, level of theft likelihood, repair cost, value in whole and in parts are fixed costs insurers take into account. In general, older models, which are safer ones, are most affordable to insure than their newer, more luxurious counterparts.

Is it cheaper to pay car insurance monthly or annually?

Although paying monthly may be more convenient, it is common for insurers to give you a discount if you are willing to pay a major part of your annual premium right at the outset of the contract. If your budget allows, it is better to pay the annual amount because you may end up saving money in the long run.

Can I get cheap auto insurance if I’m a new driver?

New driver’s rates fall into a higher category due to their limited driving history. Nonetheless, they can exploit some channels for savings like taking a defensive driving course, maintaining good grades if they are students, or joining a parent’s policy instead of having their own.